Paytronage Original Business Plan

While Paytronage is now long gone with a huge amount of learnings, I still believe the student loan market is extremely broken and our vision is desperately needed for students and universities alike:

Table of Contents

I. Executive Summary

- Overview

- Team

- Mission

- Objectives

- Keys to Success

II. Introduction

- Income-sharing Agreement Market Overview

- Market Potential

- Paytronage's Niche

- Paytronage's Value to Market

III. Market Estimates & Competition

- Size at Present

- Competitive Landscape

- Five Forces Analysis

IV. The Product

- Our Service

- How It Will Work

- User Experience

V. Entry Strategy

- Entry Strategy I - University Platform

- Entry Strategy II - Defaulted Student Debt Refinancing

- Projected Market Share

VI. Appendix

Executive Summary

Overview

Paytronage is a replacement for student loans—both a user-friendly online platform and a new style of investment vehicle called an income share agreement (ISA), which allows an individual to gain access to capital in exchange for a percentage of their future income for a certain period of time.

As recent Wharton undergraduate alumni, we, Zach Pelka and Connor Swofford, the co-founders of Paytronage, understand how confusing and clunky the process of applying for and paying off student loans can be. In addition, we're concerned with the growing mass of $1.44 trillion of student debt and the crippling effects that interest build-up and student loan default has on individuals early in their careers. We see an opportunity to provide a user-friendly alternative financing option that will benefit both students and investors.

At Paytronage, our mission is to offer everyone the financing they need to fulfill their dreams.

The total addressable market for Paytronage is expansive. The current student loan market alone in the United States is over $1.44 trillion, up more than 170% since 2006. If ISAs capture just 1 percent of the student loan market, the addressable market is $14 billion.

In a pilot study, the American Enterprise Institute offered 400 families side-by-side comparisons of student loans and income share agreements, and over 50 percent preferred income share agreements over student loans. As ISAs continue to grow in popularity, we believe they will become the education-investment vehicle of many—one which many of our peers would have preferred during college.

We will create a dual-sided platform that enables any individual seeking an ISA—which we call a "protégé"—the ability to submit their personal information and funding needs and match with an investor—which we call a "patron"—hoping to obtain a percentage of an individual's future income. We will even provide students still in high school, deciding on their future college—which we call a "pre-protégé"—the chance to compare ISA rates and the inherent value of the degree at the universities they are considering.

- To our protégés, we will provide the best available option to attend college. We give them a choice between falling into debt with a loan or being free to pursue a debt-free financing option with an ISA. We plan to support them with additional support services: career planning, financial planning, special Paytronage events, and more.

- To our pre-protégés, we will provide ISA comparison tools to help students select the best institution for them based on their funding needs and the quality of education that the university provides.

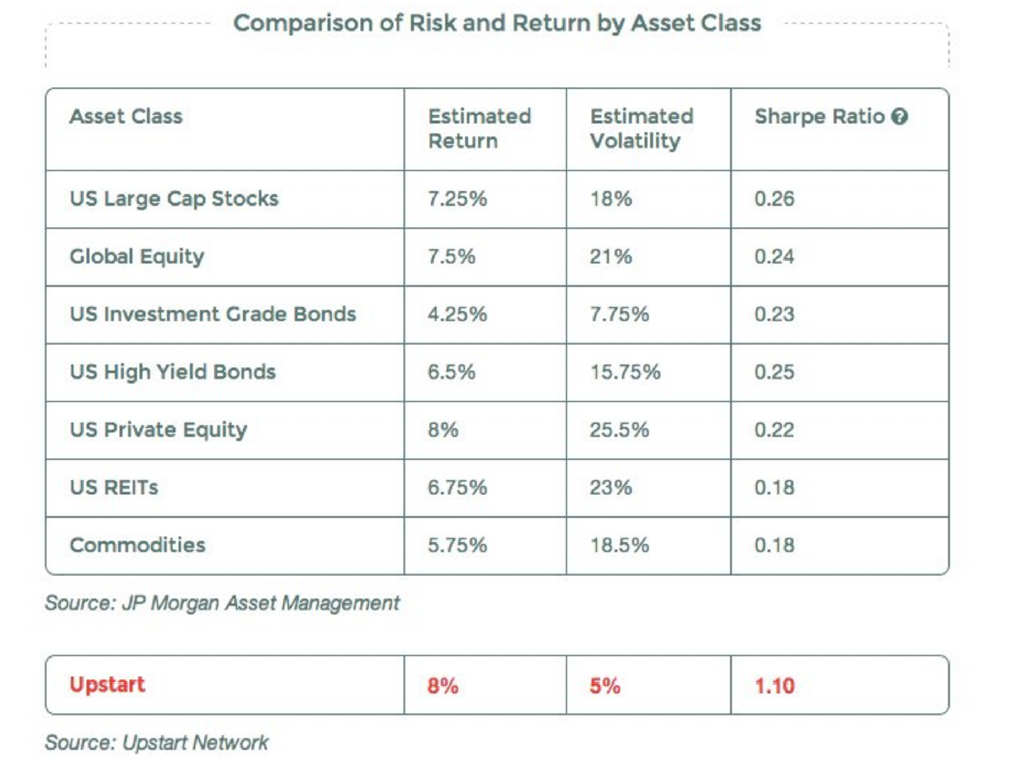

- To our patrons, we will provide a method to invest in an innovative financial instrument that will provide them strong, inflation-proof returns with low volatility. Additionally, we will offer patrons a platform to provide support to protégés across the country.

Initially, we will target universities to create institutional investment funds that offer ISAs to their students. Based on our proprietary income-prediction algorithm, protégés will see their predicted income over a period of time and select the amount of equity they are willing to give away. Once matched with a patron's ISA-fund, Paytronage will facilitate the contracting process and receive 2% of the investment the protégé is due to receive. Every month until their respective contract expires, protégés will be required to make repayments to their patron. Paytronage will receive 1% of these repayments.

Team

Zach Pelka, CEO and Co-Founder: Zach graduated from the University of Pennsylvania's Wharton School in 2017 with a Bachelor of Science in Economics with a major in Operations Management. Over several summers in Silicon Valley, Zach evaluated growth-stage tech startups as a Software Investment Analyst at Technology Crossover Ventures, worked on several high-value mergers and acquisitions in the technology landscape at PJT Partners in San Francisco, contributed to the formation of the highly-successful Target Date Funds at Charles Schwab, and led Strategic Initiatives for the launch at MerchantsOfBeverage.com, an e-commerce destination for premium wine and spirits. Zach will lead Paytronage's business and operational strategy, new product development, finance, and fundraising.

Connor Swofford, COO and Co-Founder: Connor graduated from the University of Pennsylvania's Wharton School in 2016 with a Bachelor of Science in Economics with majors in Management and Operations. In his current role as a Management Consultant at A.T. Kearney, he manages six unique work-streams for a multi-billion dollar casino creating a joint venture. As an investment banking analyst at Periculum Capital Company, he was responsible for assisting multiple multi-million dollar M&As, debt offerings, and completing due diligences on multiple startup investments. As a corporate buying analyst at Dick's Sporting Goods, he was responsible for planning the strategic product launch of Under Armour's localized clothing lines. As COO, Connor will lead Paytronage's day-to-day operations, HR, legal, marketing, and fundraising.

Evan Weiss, General Counsel: Evan is a 2015 graduate of The George Washington University Law School where he graduated with high honors and was a member of the Order of the Coif. Evan received his B.S. in Business Administration from the University of Mary Washington. While at UMW, Evan was also captain of the NCAA lacrosse team. Prior to his work at Paytronage, Evan was a corporate attorney at Holland & Knight LLP where his practiced focused on a mix of venture capital financings, mergers & acquisitions, and general corporate work. As Head of Internal Counsel, Evan will lead Paytronage's compliance efforts, LP fund structuring, and all of the legal/policy elements of ISAs and servicing as a full-time employee.

Xinyu Que, Head of Data Science: Xinyu has spent over 10 years in academia focused on different aspects of computer science, most recently receiving his Ph.D. in Computer Science from Auburn University in 2013. At Auburn, Xinyu focused on Hadoop Optimization for Large-Scale Web Analytics and Programming Models on PetaScale Cray XT5 systems. Since Auburn, Xinyu has worked at the IBM Watson Research Center innovating scalable parallel graph analytics, conducting graph application performance analysis on HPC facilities, and architecting novel architectures for large-scale and real-time graph analytic systems. Xinyu has been published 20+ times in top data science research journals around the world. Xinyu leads Paytronage's platform architecture, manages the team of 4 Ph.D. data scientists applying machine learning to the underwriting prediction algorithm, and works closely with Relibit Labs on the intersection between the web design and data infrastructure as a part-time employee.

Anthony Rodriguez, Chief Analytics Officer: Anthony is currently attending the University of Pennsylvania for Masters degrees in both Systems Engineering and Mathematics. While working at the Chicago Trading Company, a derivatives trading firm, Anthony learned key elements in effectively dealing with risk as well as the importance of data driven decision-making. Working with the Russell-2000, the NASDAQ, Eurodollar Futures, and other products has expanded Anthony's understanding of quantifiable risk and data analysis. While at Penn, Anthony researched network and graph theory as well as abstract algebra He also studied advanced mathematics, linear algebra, stochastic analysis, and helped instruct MATH170—a survey course in graph theory and proof based methodology. As CAO, Anthony will lead Paytronage's analytics teams, which will involve income prediction models, risk assessment measures, and other evaluation tools for both patrons and protégés.

Mission

Paytronage's mission is to offer everyone the financing they need to fulfill their dreams. To many, the growing cost of enrollment at many colleges and universities stands in the way of their dreams. There are undeniable effects of the psychological impact of debt: the American Psychology Association found that "64 percent of graduate students said their constant concern over debt interferes with their [mental wellness]."

We want to give all students access to ISAs. Once we see widespread adoption of ISAs, we will see more people invested in the potential of our youth. As such, the rate of growth we've seen over the past decades will be accelerated further. If the protégé succeeds, everyone wins.

Objectives

Our main objective is to create a user-friendly marketplace for the purpose of exchanging cash investments for equity – a stake in an individual's future earnings. With the recent adoption of income share programs by departments within top universities such as the Purdue University, there has been a legislative push for the wide-scale adoption of similar programs across the country. However, the creation and administering of programs, such as Purdue's Back a Boiler program are incredibly time- and cost-intensive.

Therefore, our goal is to make a university or institution's adoption of an ISA program as simple as setting up an investor profile and investment requirements. For example, if Stanford University wants to develop an ISA program for its students, which we see as "when" rather than "if", it will be significantly easier to set up and offer ISAs to its students via Paytronage, rather than spend their own funds to create a platform.

In the long term, our goal is to develop a financial clientele that will extend equity-investing past traditional educational lending—rivaling traditional lending. While this is a significant market to address, the development of ISAs as a student-loan alternative will normalize the legitimacy of the investment vehicle, and therefore create the need for a marketplace that sells ISAs as an alternative form of lending.

Keys to Success

Several factors will determine the success of Paytronage:

- RAISE UNIVERSITY/INSTITUTIONAL FUNDS Initially, Paytronage will systematically target universities and institutions to create preliminary investment funds on our platform. Later, once our dual-market platform has been established, we will market to students whose universities have not joined our platform, allowing them to pressure additional institutions to consider offering ISAs with Paytronage.

- EFFECTIVE LEGAL NAVIGATION With the recent development of ISAs at major universities, precedent is quickly being set for their legal operation. In fact, a bill has already been put forth to regulate ISAs. Paytronage will develop a sound and effective relationship with the SEC, IRS, and FINRA to abide by all regulatory measures put into place, as well as develop an ongoing income-verification and collection/payment process.

- ADOPTION OF ISAs Paytronage is entering the market at an ideal time with the normalization of ISAs in universities and new legislative support. As proven by the AEI's 2017 study, the concept of personal equity-investing contracts is likely to become a much more trusted financial instrument. Once trusted individual entities begin offering varying ISAs on Paytronage's platform, it will provide both patrons and protégés a wider variety of investment and recipient options on a trusted platform.

- USER-EXPERIENCE Our user experience is based on simplicity. Paytronage will develop a user experience similar to that of Warby Parker or Casper. These companies take a complex product with many substitutes and eliminate the knowledge gap, while providing an easy-to-use interface. They make the customer's decision to purchase easy and simple. As recent college graduates, we will design Paytronage's interface to the preferences of millennials—our future protégés.

- PAYTRONAGE'S PREDICTION ALGORITHM It will be crucial that Paytronage accurately predicts a protégé's future income. This proves mutually beneficial to both protégés and patrons by allowing both parties to understand and evaluate the type of contract they could be entering. Paytronage's income prediction algorithm will take into account data streams from the US census and from universities. It will be based on a variety of factors: a person's age, occupation, university, major, GPA, test scores, and other factors that can influence income levels.

Introduction

Income Share Agreement Market Overview

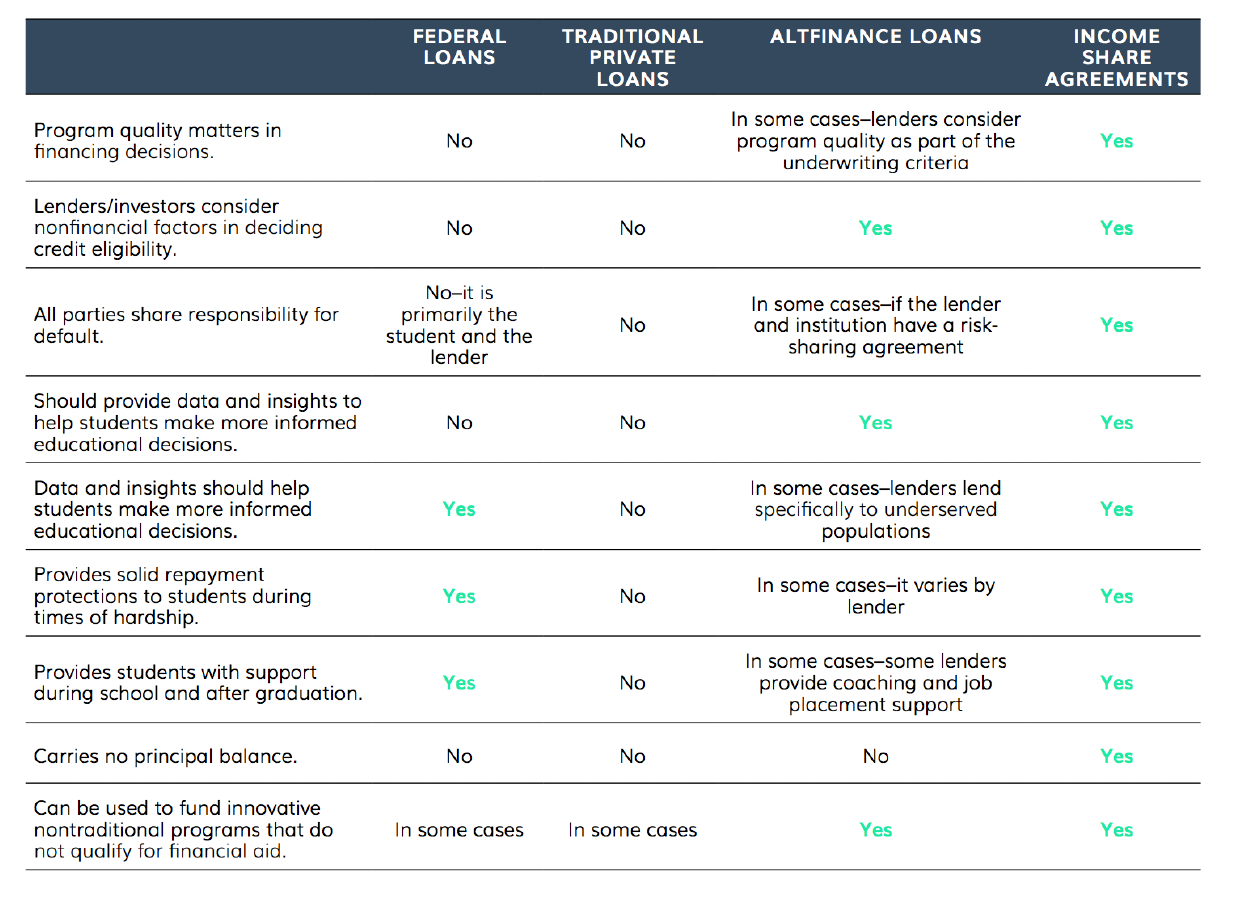

PRIVATE STUDENT LOANS vs. ISAs

Typically, students finance their college education through grants, scholarships, federal loans, private funds, and then pay the remaining sum through private loans. These private loans are the instruments that ISAs have the easiest ability to replace. In the future, they may replace federal loans, too. In the meantime, it is important to understand the primary differences between private loans and ISAs:

Typical characteristics of private student loans:

- Many require payments while a student is still in school.

- Variable or fixed interest rates. Variable rates can sometimes range greater than 18 percent.

- The student must pay the interest on the loan.

- Required established credit record.

- May need a cosigner.

- Interest may not be tax deductible.

- Multiple private student loans cannot be combined into a Direct Consolidation Loan.

- Unlikely to receive loan forgiveness.

Typical characteristics of ISAs:

- Requires payment only when student income is above Minimum Income Threshold (MIT).

- Fixed percentage of income for entirety of contract.

- Considers nonfinancial, merit-based factors when determining eligibility.

- Investor shares in the risk of financing a student's education.

- No cosigner required.

- Allows students to carry no principal balance.

- Length of contract is measured in payment years, not calendar years.

TYPICAL ISA CONTRACT

According to Entangled Solutions, the average ISA recipient offers 3.45 - 8.33 percent of income for 8.5 to 15 years. Based on Purdue University's program, the average size of an ISA contract is roughly $14,000.

There are several unique aspects of an ISA contract that can be adjusted:

- INVESTMENT LENGTH - number of payment years the contract requires, not calendar years.

- INCOME PERCENTAGE - percentage of gross income an ISA recipient is required to pay.

- MINIMUM INCOME THRESHOLD - if the recipient earns less than a predetermined income (e.g. $20,000) in a given year, then their payment is deferred a year. This protects recipients from hardship during economic struggles and offers investors protection from low returns.

- MAXIMUM PAYMENT CAP - maximum cumulative payments that a recipient will pay on their ISA (e.g. 3X a $10,000 ISA = $30,000 max)

- ACCELERATED PAYMENTS - ability to pay higher equity amounts for shorter period of time - similar to loan refinancing.

From the investor side, only accredited investors are allowed to fund an ISA. Investors can adjust their targeted return by manipulating the ISA's equity percentage or contract lengths.

ISA EXAMPLE

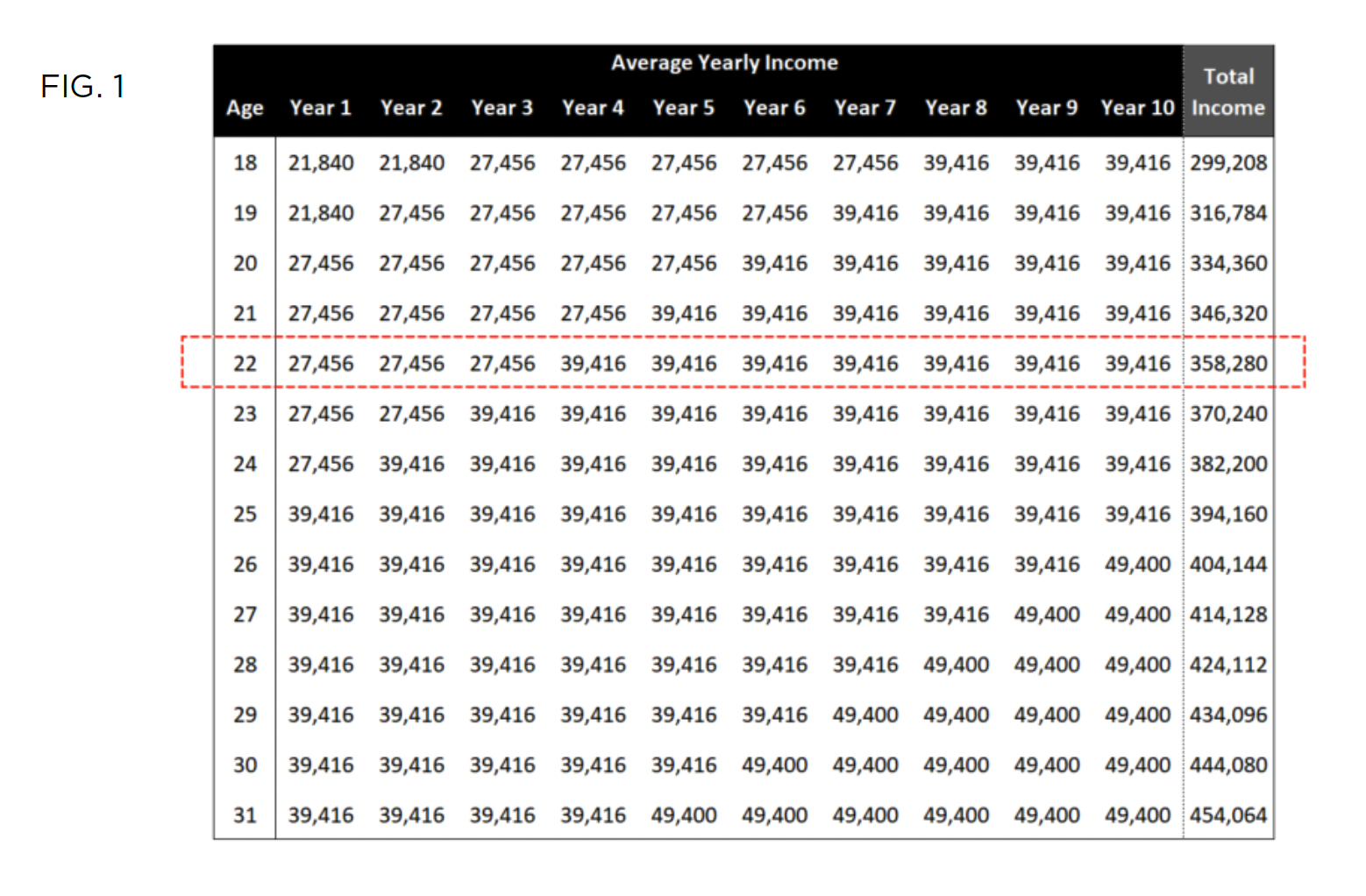

In the following example, we will walk through three figures to explain how an ISA is created between an investor and recipient. First, a recipient desires an investment for an endeavor. They determine they will sign an ISA in exchange for a portion of their future income. In our example, we depict a recent 22-year old college graduate who desires a $10,000 investment. Figure 1 highlights the 10-year average income of a 22-year old using US census data.

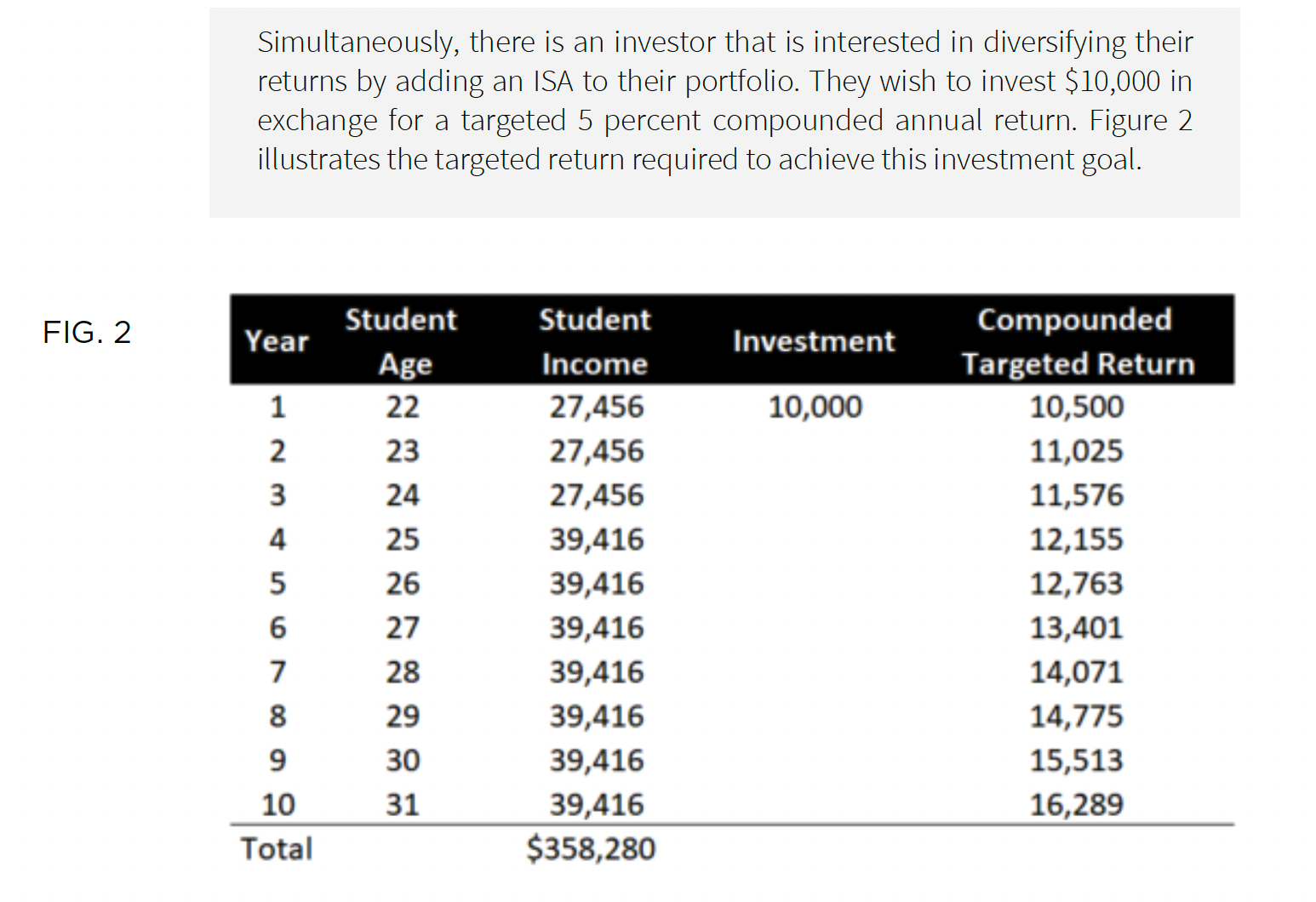

Simultaneously, there is an investor that is interested in diversifying their returns by adding an ISA to their portfolio. They wish to invest $10,000 in exchange for a targeted 5 percent compounded annual return. Figure 2 illustrates the targeted return required to achieve this investment goal.

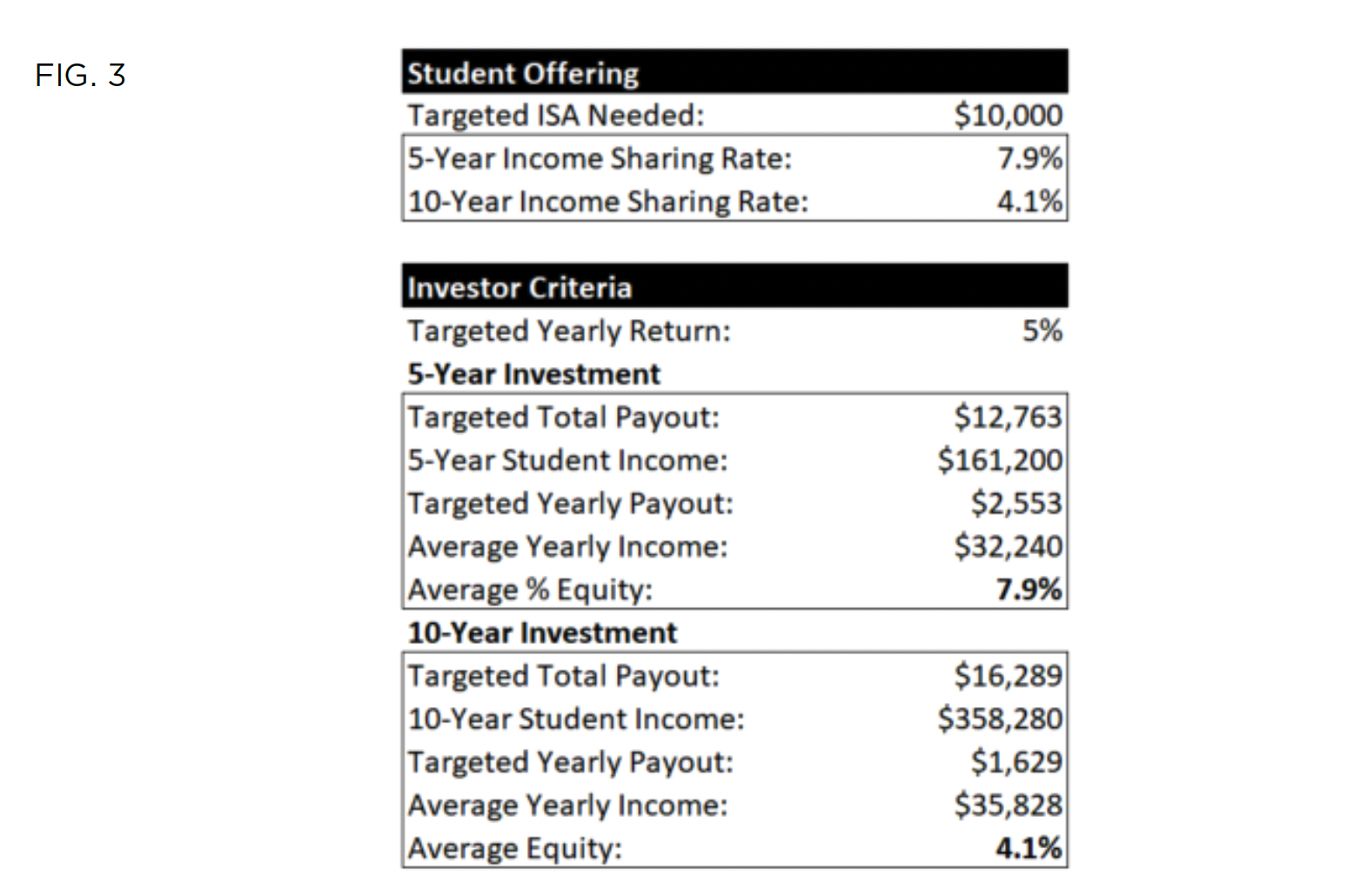

Finally, the investor and 22 year old are matched. Figure 3 illustrates the investor's targeted yearly payouts needed to reach their 5-Year and 10-Year goals. To achieve the targeted 5 percent compounded annual return, over 5 years the investor would offer a 7.9 percent ISA, and over 10 years the investor would offer a 4.1 percent ISA. In this instance, we'll say the 22 year old agrees to a 10 year ISA. She receives $10,000 immediately in exchange for 4.1 percent of future income.

BENEFITS OF ISAs

According to Entangled Solutions, ISAs innovate the lending market in three unique ways:

- Investors and schools are on the hook if students do not financially succeed after graduation, versus some failing federal loans, which cost taxpayers.

- Funders are incentivized to help their student(s) succeed financially.

- Unlike federal aid programs, schools may have skin in the game and do not have access to endless capital, which incentivizes them to keep the quality of their degree high.

INVESTOR BENEFITS

- Investment into student's futures - as students succeed, so do investors.

- Returns are predictable with enormous potential upside, and a capped downside based on deferred payments from not meeting MIT.

- Low volatility given pilot ISA programs.

- Inflation proof-investment given link to student's rising salary.

- Investments with 10+ years of cash flow.

RECIPIENT BENEFITS

- Immediate funding with no required use of spending.

- Variable payment prevents payment obligations during times of economic hardship.

- Deferred payment allows for alternative career paths before repaying ISA.

- No need for credit or collateral.

- Ability to buyout contract in cases of high income accrual.

- No interest payments.

- Less psychological cost of debt.

LEGISLATIVE PUSH

Given ISAs growing popularity, there has been a push on both sides of the political aisle to categorize and regulate these new investment vehicles. According to Alexander Holt, a policy Analyst for New America, a left-leaning Washington, D.C. think tank, "ISAs don't follow normal partisan lines. They have potential to be 'purple' - supported by both "red" and "blue" factions."

In the outstanding bill S. 268. 2017, also known as the "Investing in Student Success Act of 2017" sponsored by Connor and Zach's respective Senators, Todd Young and Marco Rubio, the bill aims "to provide the legal framework necessary for the growth of innovative private financing options for students to fund postsecondary education, and for other purposes." This bill will make ISAs a valid and enforceable contract. Effectively, this will authorize the use of ISAs in place of any other financing vehicle an individual would use to raise money.

Other critical aspects of the bill include:

- ISAs are not debt instruments and the amount that the recipient will be required to pay may be more or less than the amount borrowed, and vary based on future income.

- ISAs are not dischargeable under bankruptcy law, except in a case that would impose an undue hardship on the debtor and the dependents of the debtor.

- The investor or contract holder will not have any rights over the actions of the recipient.

- The ISA must acknowledge if the contract may be exited early with accelerated payments by the recipient.

- The ISA must outline the duration of the contract and specify any circumstances under which the contract would be extended.

- The ISA must state the percentage of income the individual is committing to pay and the minimum income threshold requiring the individual to make payments each year.

- The ISA must define "income" used for calculating the future obligations of the recipient.

- The ISA must disclose the amounts the recipient would be required to pay at a range of reasonable annual income levels and compare this to the amounts required to be paid under a comparable loan bearing interest at a fixed annual rate of 10 percent.

- Firms that primarily make ISAs are excluded from being classified as Investment Companies in the Investment Company Act of 1940.

- Recipients cannot give away more than a total of 15 percent of pledged future income.

- ISAs are not subject to state laws that limit interest rates or assignments of future income.

The constructs of the bill surrounding the formation of ISAs are highly similar to the way ISAs are being shaped today by universities and organizations. This congressional push highlights the market potential and its current premature state.

Market Potential

We anticipate recipients of ISAs to grow as more individuals learn about ISAs. In January 2017, a blind study conducted by the American Enterprise Institute, a top education think-tank, surveyed more than 400 families. The study found that only 7 percent of students and 5 percent of parents had ever heard of an ISA; however, when given a side-by-side comparison with private loan options, more than half of those surveyed preferred an ISA over traditional loans. As the ISA push continues federally and within the private sector, the social acceptability of these contracts will rapidly grow.

Paytronage's Niche

Rather than each investor attempting to create their own product, they can instead use Paytronage's marketplace as their investment platform. Given that there are 4,500+ higher education institutions yet to create an ISA program, and 20.5 million students were expected to attend an undergraduate US college or university in 2016, there is an opportunity for Paytronage to create a centralized platform for institutions to join, offering them a bridge over all the legal, administrative, and data-driven barriers to ISAs. Furthermore, one of Paytronage's competitors, Lumni, has seen average fund returns of 9.1 percent and in one year, the University of Purdue invested $2.2M into their students. These statistics highlight a lucrative market gap that Paytronage will fill.

In Paytronage's 10-year plan, we will create a pooled investment vehicle whereby non-accredited investors can invest into a fund, similar to a mutual fund, which Paytronage invests into a pool of recipients. Paytronage will group ISA-funds based on similar characteristics, such as university, demographic, occupation, IQ, test scores, etc.

Paytronage's Value to Market

Paytronage provides a needed value to the market by creating a platform for different universities and institutions to gain access to the ISA market.

As an example, Harvard can create a Harvard fund, in which any Harvard student or alumnus can receive a Harvard-sponsored ISA through the Paytronage platform after having met the necessary investment criteria. This additional criteria might include mandating a targeted fund return rate, the ability to buy out the contract, a minimum income threshold, GPA minimums, major, or many other variables.

The current investment model that is spreading throughout the US, such as at Purdue University, has limits on the capital a student can receive from their ISA and the rate is based solely on their major. Paytronage plans to use one's major in conjunction with many other meritocratic factors in its income-prediction algorithm. Currently, students can only receive ISAs from their respective university. Over time, Paytronage's platform will offer many different ISAs, enabling students to compare different ISA rates. For example, a young African American student at Purdue University might be able to receive an ISA from the NAACP or the University of Purdue. As more patrons join the platform, protégés will eventually be able to choose their ideal equity rates from multiple offered ISAs, thus optimizing their valuation. In addition, as the pool of protégés grows, patrons will be able to create more specific investment criteria.

Market Estimates & Competition

Size at Present

There are a few different ways to analyze the overall potential market size for ISAs.

Looking at the Class of 2016, the average undergraduate graduated with nearly $34,000 of debt. Given there are 20.5 million students in college in the US per year, each new incoming class will take on $174B of debt. This means the recurring market that ISAs can penetrate is $174B.

Broken down further, the majority of loans taken out by undergraduates are Federal Loans. Roughly 20% of the loans taken out each year are private, making the yearly recurring private loan market $34B. However, we believe ISAs will also compete with remaining $140B of federal loans due to the constructs of the contracts such as minimum income thresholds, income based repayment (with a cap on length which differs from the Federal REPAYE Programs), and no interest.

Of the $1.44T outstanding student loans, many could be refinanced into ISAs. While not recurring, this will become another area of penetration for the ISA market.

No matter how one calculates the market size—penetrating yearly undergraduate loans, yearly federal loans, yearly private loans, or the ability to refinance existing student loans—the potential market size for ISAs is immense.

Competitive Landscape

As far as competitors in the space, the existing firms that are focused specifically on ISAs are incredibly slim. The most notable organizations are Lumni, Align and Vemo Education. While there has been recent, positive development in the space, it should be noted that no competitor has a similar marketplace-based model to Paytronage.

ALIGN (formerly CUMULUS FUNDING) Align, one of the newest members in the ISAs space is a positive proof of concept. Align recently raised $31M Series A ($6M Equity Valuation and $25M Debt Financing Facility) after offering roughly 500 ISAs—a valuation at over $60,000 per ISA. The Series A was led by Continental Investors LLC along with Technologies, D-W Investments, Bridge Investments and Service Provider Capital—depicting Chicago VCs' bullish views on the space.

Align's business model differs from Paytronage. Align first collects money from investors into one fund and then Align offers ISAs to select individuals. Investors only have a share of the overall profits that Align returns. There appears to be no current focus on universities or getting institutions onto their platform.

LUMNI Lumni, headquartered in Bogota, Columbia, mainly operates in Latin America. Lumni, began investments in 2002 in Colombia and Chile with an $837,000 fund and has since expanded to Peru, Mexico, and the United States (though offering only 30 ISAs), and raised more than $50 million of investment funds. As of 2016, it has assisted 8,000 students from low-income families and vulnerable communities. Nearly half of Lumni's students are women, and 58 percent are first-generation students. About 70 percent of Lumni's investments, or about $18 million, have gone into 22 corporate funds, which the client defines investment requirements. For example, funding may be reserved for students affected by armed conflict, from indigenous communities, with disabilities, or are children of the client's employees.

To date, approximately 3,000 of Lumni's students have graduated and 1,200 have satisfied their payment obligations. Two 10-year funds have already closed in Chile. The first paid an 11.2 percent return to investors and the other paid a 15.3 percent return. On average, the return to investors across all countries is 9.1 percent with a default rate of only 2 percent.

VEMO EDUCATION Vemo Education, headquartered outside Washington D.C., is currently the only organization that is working with universities on implementing university-controlled ISA program. Vemo worked with the University of Purdue to create the university's ISA platform through purdue.edu; however, this still required a substantial amount of work on the university's part. Vemo has a much less scalable business model than Paytronage. Instead of maintaining one centralized platform, Vemo is a service provider for universities to build out individual ISA programs.

UNIVERSITIES While the University of Purdue used the help of Vemo to create its ISA platform, other universities have tried to create similar platforms before. Both Yale University and the University of Oregon independently attempted to create ISA investment platforms, and it is possible that more universities will wish to undertake this venture.

13th AVENUE FUNDING Founded in 2009, 13th Avenue Funding is a non-profit pilot program offering ISAs. Its model is unique because the financing relationship is local - investors and recipients are members of the same community. Thus, 13th Avenue's model bears a stronger resemblance to informal funding arrangements among friends and family.

13th Avenue has been piloting its program at Allan Hancock College in Santa Maria, California. It plans to grow its funding model to other local community groups. To that end, 13th Avenue has made its documents publicly available for use under a creative commons license, along with instructions on how to create a "college financing community."

FANTEX Fantex is an Athlete-Tracking Stock Startup, which recently raised $60M in a private placement led by UBS Group AG. Based in San Francisco, Fantex, buys the rights to an athlete's future earnings in exchange for proceeds from selling shares linked to an athlete's brand and performance. The first offering was on behalf of Vernon Davis in November 2013, when he played for the San Francisco 49ers. Fantex sold a tracking stock linked to the tight end for $10 each and paid him for 10 percent of future earnings.

INCOME DRIVEN FEDERAL LOANS In 2009 the Obama administration introduced the first income-based repayment programs for traditional student loans to students. Titled income-driven repayment plans, a monthly student loan payment is intended to be affordable based on one's income and family size. The repayment rates are typically set based on discretionary income (income after deduction of taxes, other mandatory charges, and expenditure on necessary items). The amount needed is based on the plan.

Under all four plans, any remaining loan balance is forgiven after the repayment period. These plans are:

- REVISED PAY AS YOU EARN REPAYMENT (REPAYE Plan) - generally 10 percent of discretionary income; 20 years.

- PAY AS YOU EARN REPAYMENT (PAYE Plan) - generally 10 percent of discretionary income, but never more than 10-year Standard Repayment Plan; 20 years.

- INCOME-BASED REPAYMENT (IBR Plan) - generally 10 percent of discretionary income, but never more than 10-year Standard Repayment Plan; 20 years.

- Income-Contingent Repayment Plan (ICR Plan) - the lesser of 20 percent of discretionary income or what you would pay on a repayment plan with a fixed payment over the course of 12 years, adjusted according to your income; 25 years.

Monthly payments are "recertified" based on income and family size. If someone doesn't certify income by his or her annual deadline, any unpaid interest will be capitalized (added to the principal balance of the loan). This payment scheme varies based on the different types of federal loans a student takes out - each different loan type is either eligible or not eligible (15+ different loan types).

Five Forces Analysis

- THREAT OF COMPETITOR RESPONSE (Industry Rivalry) - MEDIUM Intense competition does not currently exist in the ISA market. Given that Lumni has a board of directors in every country it operates in except the United States, we do not foresee them as a threat. However, Vemo or Align may try to pivot their model and create a platform similar to Paytronage. If this occurs, we view this as beneficial for Paytronage—the major limiting factor on our success is the widespread acceptance of ISA platforms, not a competitor. There are over 4,500 higher education institutions that will need to develop an ISA program in coming years, which makes the market vast enough for multiple players.

- THREAT OF NEW ENTRANTS - LOW In a paper published by the Brookings Institute, top economist and University of Michigan Professor Susan Dynarski cites the "high administrative barriers to accessing [ISAs]," is a critical reason for the current lack of ISA offerings. Barriers to entry in the space include having a number of willing investors, recipients, and an algorithm to predict future earnings for ISAs. Also, investors will need to have faith that they will see strong and predictable gains from their investments.

- THREAT OF SUBSTITUTES - HIGH Forms of alternative lending have grown in recent years. In 2012, these companies attempted to enter the equity investment field as kickstarter-based investors, but have now pivoted to offer "smarter" loans instead. UPSTART Upstart was founded in 2012, beginning as company that invested in ISAs with constructs similar to the proposed congressional bill. Recipients had 2-months to reach their funding goal, and if they did not reach the minimum $10,000 pledge, they did not receive any funding—a business model very similar to Kickstarter. Upstart capped investor payback at a 5x investment valuation. Later, Upstart had an investment option where investors could invest in a fund of all upstarters that targeted an 8 percent return. In 2014, due to more opportunity in AltFinance, Upstart pivoted to offering loans with an adjustable APR based on your degree of education. PAVE Pave was founded as a spinoff from Upstart with a very similar business model. Like Upstart, due to more opportunity in lending, Pave has since pivoted to sell specialized 2-3 year loans for use towards education, business, etc.

- BARGAINING POWER OF SUPPLIERS - LOW Suppliers are nearly non-existent in this market as the main products will be offered as a cloud-based service. The main suppliers will be hosts of any platforms used.

- BARGAINING POWER OF BUYERS - LOW Buyers are both protégés and patrons. Given they must use an ISA platform in order to match with one another, they have little negotiating power. While it is possible they can proceed with their ISA independently of Paytronage after being matched, doing so means they will not have the legal counsel, income verification, support and many other services that ISA offers to its contract holders.

The Product

Our Service

We want Paytronage to offer financial freedom to those receiving funds as much as it offers a strong return to our patrons. ISAs align incentives - when our protégé succeeds, so does their patron.

SERVICES PROVIDED To our protégés, we will provide the best available option to attend college. We give them a choice between falling into debt with a loan or being free to pursue a debt-free financing option with an ISA. We plan to support them with additional support services: career planning, financial planning, special Paytronage events, and more.

To our pre-protégés, we will provide ISA comparison tools to help students select the best institution for them based on their funding needs and the quality of education that the university provides.

To our patrons, we will provide a method to invest in an innovative financial instrument that will provide them strong, inflation-proof returns with low volatility. Additionally, we will offer patrons a platform to provide support to protégés across the country.

Our product is a marketplace for protégés and patrons to meet, providing the opportunity to exchange capital for long-term investment into a protégé's future financial success. We are providing a mutually beneficial option that results in further innovation without the need for raising debt.

PAYTRONAGE SCHOLARSHIP In accordance with our mission to "give students of all backgrounds the chance to achieve their dreams," Paytronage will offer all protégés the opportunity to win our monthly $5K scholarship. Once a protégé has submitted their protégé profile, they will automatically be entered into our lottery. From then on, every month they will be required to resubmit into our monthly scholarship. Winners will be notified via email if they're one of our scholarship winners. If so, they must claim the scholarship before the end of the month. In addition, once a protégé wins the monthly scholarship, they will not be able to win another scholarship. Furthermore, protégés cannot create duplicate accounts as a social security number is needed when creating a profile. The Paytronage scholarship program will commence in year 2 once we begin aggressively targeting user adoption.

How It Will Work

OUR CONTRACTING PROCESS

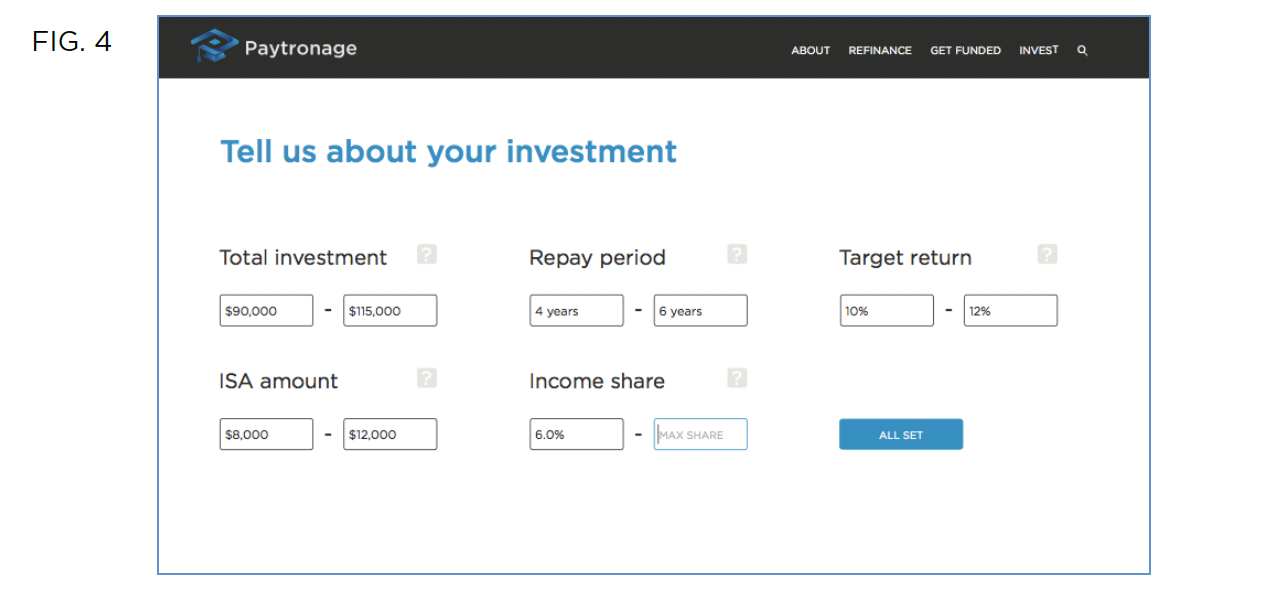

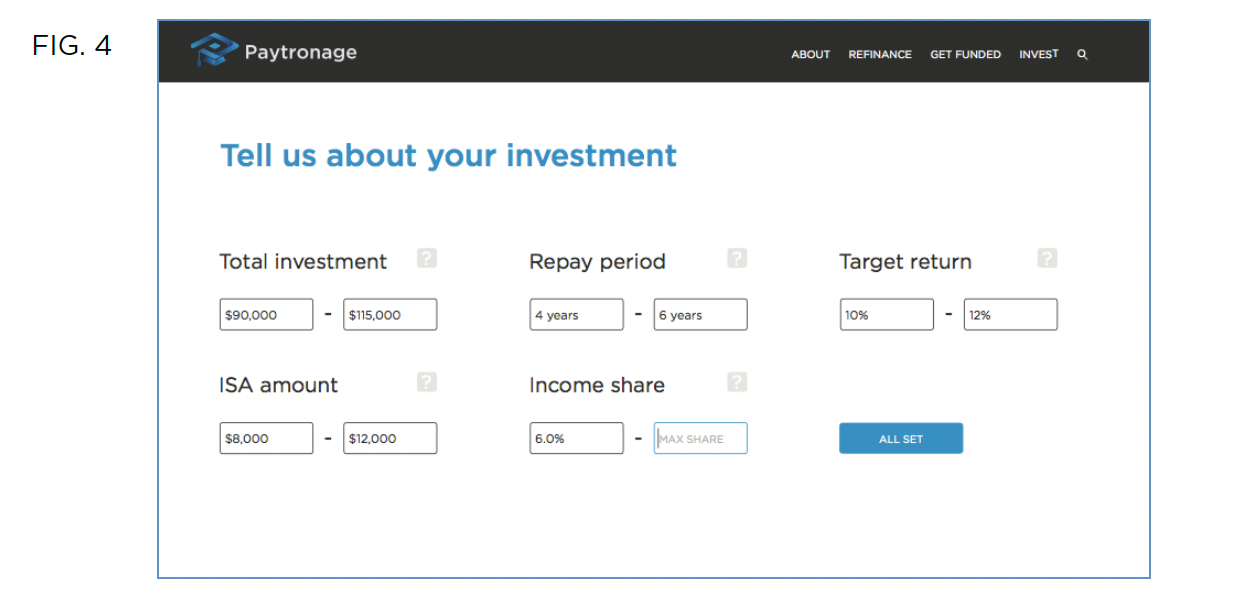

Patrons will create an ISA Fund on our platform with the ability to customize their required investment criteria: investment rates, targeted returns, demographics, future occupation, education, minimum income threshold, accelerated payment options, contract buyout rates, minimum/maximum investment length and minimum/maximum income shared, etc. Each patron will invest into their respective ISA Fund through a simple and interactive process. There will be no cost to create a fund. At any point, Patrons will have the ability to withdraw or add more capital to their respective fund. The beginning of this process can be seen in Figure 4.

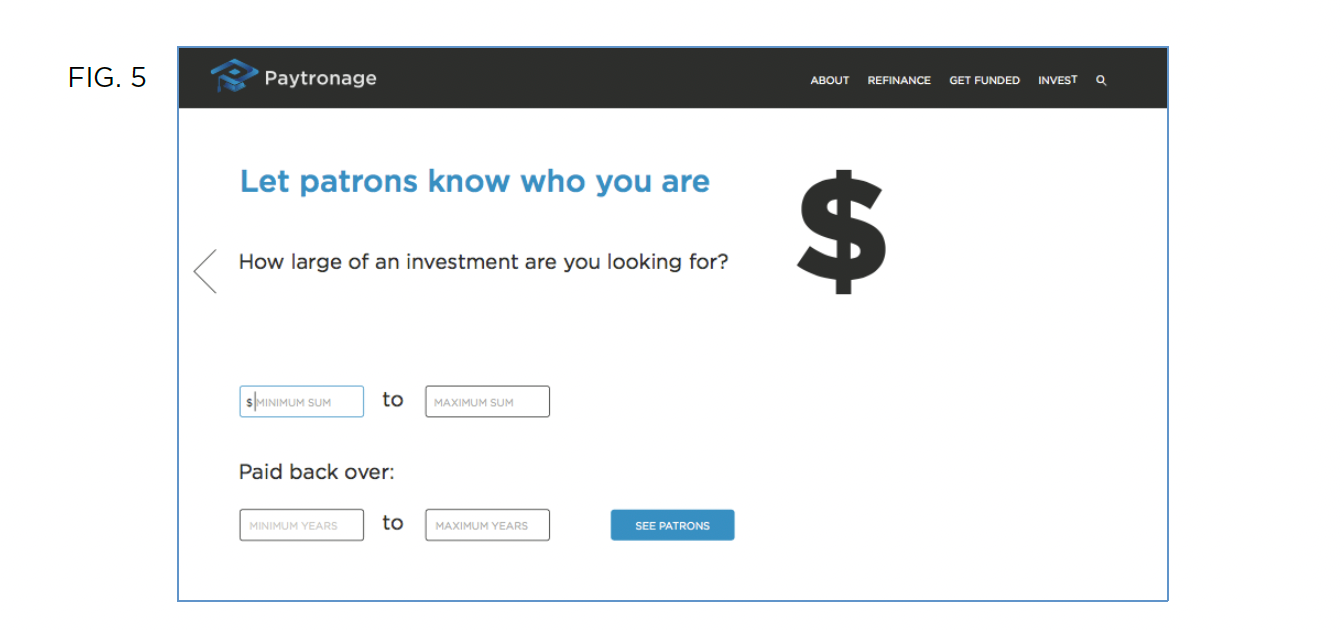

A protégé will create their profile by walking through several simple questions when filling out the required background information. In their application, protégés will indicate a significant amount of financial and merit-based information, such as FICO score, education level, test scores, and occupation. Students will also submit their funding needs. Part of the process is highlighted in Figure 5.

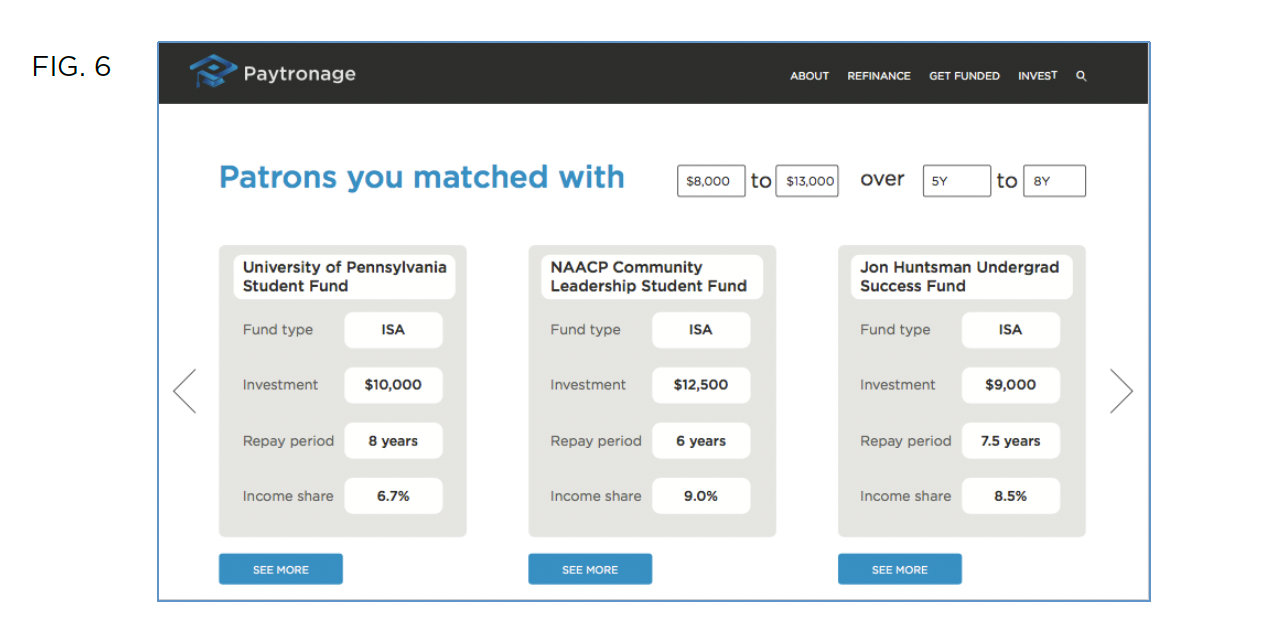

Based on patron requirements, protégés will only view the ISAs for which they qualify, as shown in Figure 6. Paytronage's algorithm will offer students different ISAs on a sliding scale (e.g. 8-year plan at 6.7 percent equity, or 6-Year plan at 9.0 percent equity), which takes into account the time value of money and compounding effects of the desired return rate.

Once a desired ISA is chosen by a protégé, Paytronage will use a series of verification techniques to ensure complete accuracy of the protégé information provided. Protégés will be required to upload a copy of their driver's license, passport, or state identification to prove their identity. We will partner with an ID verification service to complete background checks on each individual. This will confirm the education history, credit score, criminal history and many other factors to confirm the individual's predicted future income. The protégé will need to upload a latest copy of their high school and college transcript.

Upon completion of the verification process and once the contract has been agreed to, Paytronage will receive and transfer the lump sum from the patron's ISA-fund to the protégé's linked bank account. Paytronage will receive 3 percent of this upfront investment. In conjunction with the IRS, FICO, FINRA, and the SEC, Paytronage will provide additional services including monthly payment facilitation, based on income verification through our ability to monitor individuals Tax Returns. Every month, protégés will be required to repay their patron using Paytronage. Paytronage will receive 2 percent monthly on the repayment to patrons. Every year, a protégé will receive a notification to upload their Income Verification forms (IRS Form 1040 and 4506-T).

In the long term, Paytronage will offer investment opportunities for non-accredited investors, too. Paytronage will do so by offering pooled-investment funds. We will create funds based on any variety of unique identifiers (e.g. Harvard undergraduates, pre-med students, African-American business women), effectively creating a completely new investment class to help diversify traditional portfolios. These investors, both non-accredited and accredited, will buy shares of their desired Paytronage fund and Paytronage will take each fund and invest it into protégés that meet the fund's criteria. These pooled-investment funds will be monetized with the same 3 percent and 2 percent payment schedule. We plan to treat our ISA funds similarly to private label vs brands in consumer retail. As such, Paytronage will focus heavily on the growth of this "private label" business-line.

PRE-PROTÉGÉ UNIVERSITY COMPARISON

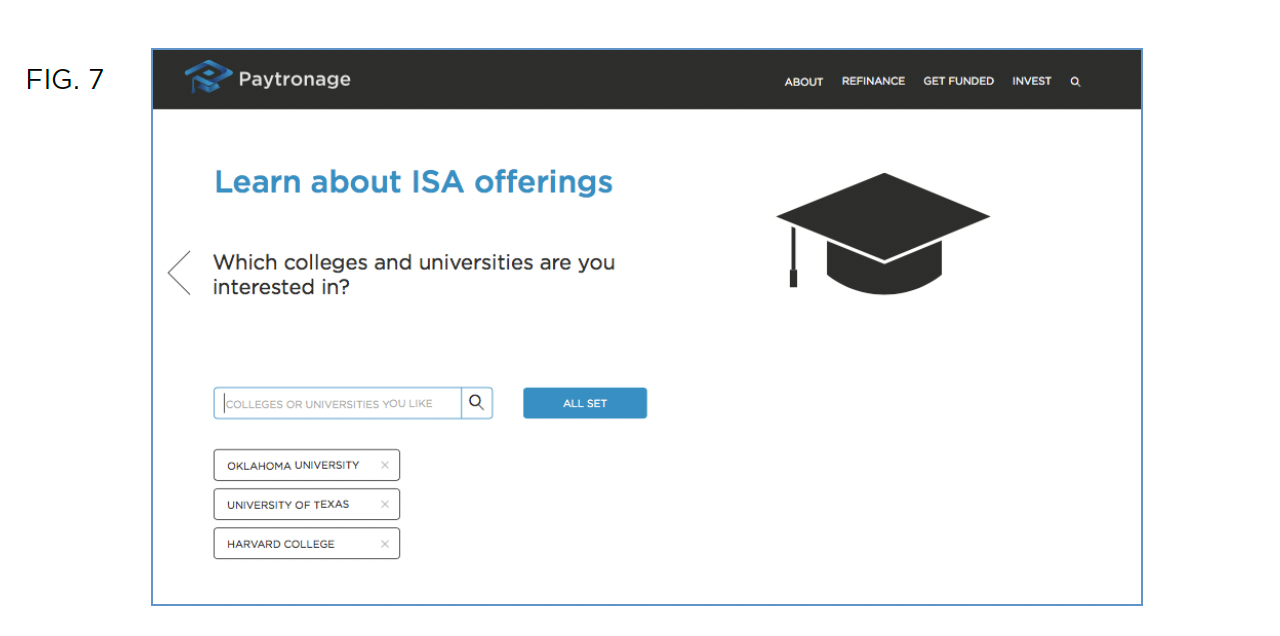

In addition to being a marketplace for patrons and protégés to meet, will establish a portal for pre-protégés to evaluate the universities they are considering, as shown in Figure 7. While unable to enter a contract until they are 18 years old, this evaluation tool will give the students the chance to assess the price-to-outcome of each university.

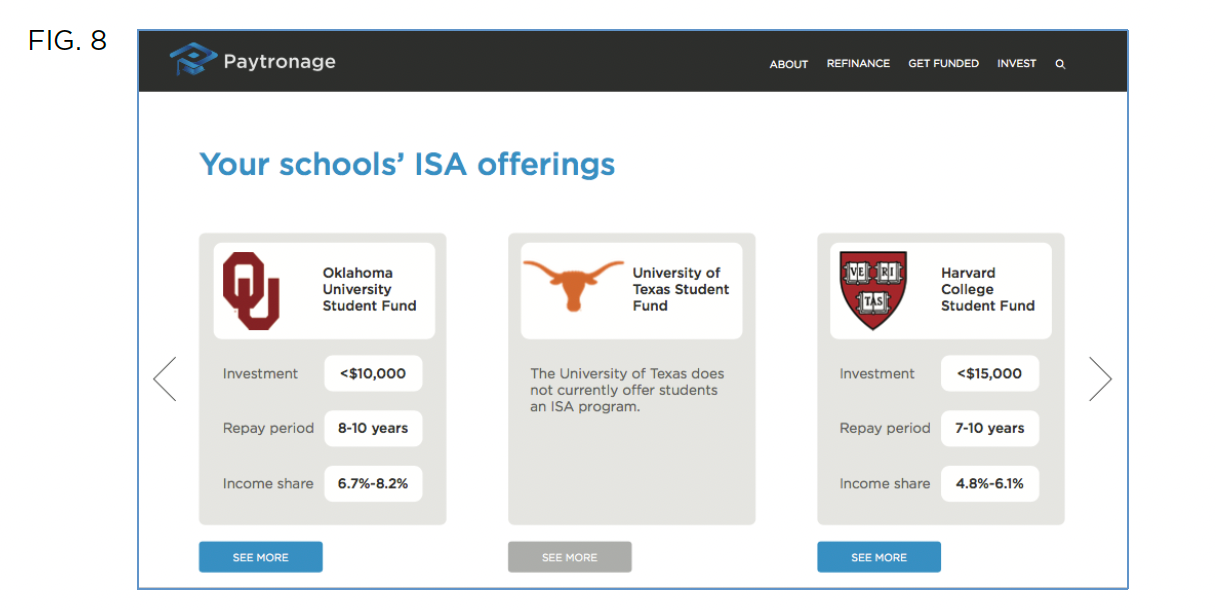

Rather than a college student filling out a full application and receiving exact rates from the different funds they qualify for, pre-protégés will fill our their application, specify universities they are considering, and see the hypothetical ranges for which they qualify. The output would be something similar to Figure 8.

In this example, a pre-protégé can compare the effective cost of attending the University of Oklahoma, University of Texas, or Harvard University. Since Harvard's 10-Year ISA is only 6.1% of predicted income rather than 8.2% of income for a Oklahoma University student, a pre-protégé would see that a degree from Harvard is more "valuable" and would require less income given away.

Another innovative aspect of this output is the impact on the University of Texas. Because University of Texas typically competes for top students with the Oklahoma State University, this output creates immense pressure on the University of Texas to create a fund on Paytronage—thus creating a viral network effect. As more schools are on platform, more are required to join—accelerating our growth.

Given pre-protégés may be considering different financial packages from each university, we plan to have an additional feature to allow students to input this information. For example, a pre-protégé could input the required ISA investment for each university. Based on Figure 8, Paytronage will depict the respective income-based cost to attend each university, allowing pre-protégés to compare each school's cost of attendance.

User Experience – Protégés

Paytronage will give our protégés an overall user-experience that makes it easy to understand and click through their qualifying ISAs. These are complicated financial instruments, and protégés may be hesitant to enter a contract, but we do not want this to stem from an inability to navigate our platform. Instead, given our protégé target market is 18-25 year olds, we will present them with relatable content and unique features, as simply as possible.

CONTENT Loans are not exciting for students—if anything, they cause anxiety and fear. Paytronage plans to paint a much different story for ISAs.

We will offer a visual home page, with story-telling that describes real-life opportunities that ISAs have provided other students, such as traveling after graduation, pursuing a startup, or going straight to medical school. In a sense, we will be giving our protégés a blank canvas to paint their own story. Once they have started to imagine the possibilities with an ISA, we will educate them further on an ISA and the benefits it provides. We will focus heavily on the 'insurance policy' it provides during times of economic hardship, as protégés are likely concerned about the debt they already believe they have to undertake to attend college.

SIMPLICITY The overall process for applying for federal loans takes an exhausting amount of time and research. For example, on studentaid.ed.gov, students have choices between: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, Direct Consolidation Loans, Subsidized Federal Stafford Loans, Unsubsidized Federal Stafford Loans, FFEL PLUS Loans, FFEL Consolidation Loans—this is only for a 10-year standard repayment program. There are eight separate repayment options, which all have different intricacies and differences. The process is overwhelming for the most financially literate student, let alone the average high school senior.

Instead, our protégé profile will only require basic information. Upon submitting one's profile, protégés will immediately review the ISAs for which they qualify. This process will take no more than 5 minutes.

Given the complexity of ISAs, our content writers will describe ISAs in relatable terms, with relatable examples. They will show the comparative advantages of our ISAs to traditional loans. We will not let a lack of understanding be the reason a student does not wish to become a protégé.

DESIGN Like the best consumer facing sites on the web, Paytronage will employ simple and elegant mobile-optimized design. It will feel fresh, current, and on-trend for a millennial audience. Our landing page will use parallax scrolling, and we will create interactive graphics for students to compare different scenarios and see the corresponding cost of an ISA vs. traditional loan. Finally, after choosing their patron, students can use more interactive graphics to see the different income percentages and corresponding contract lengths of their ISA.

User Experience - Patrons

Given the large sums of capital patrons are deciding to invest into our platform, it is key to guide them through the benefits of their investment. Similar to protégé user experience, we will focus on content, design, and simplicity when creating the patron user experience.

CONTENT ISAs provide investors the ability to receive economic and societal benefits from their investment. We plan to walk investors through a story centered around the strong, predictable returns they have the potential to obtain, while also benefiting the life of a student. We'll also have a separate page guiding the investor through the ISA process and how Paytronage plans to handle every operational and legal step of the way.

SIMPLICITY We do not want to give the impression that this is a complicated investment. With the content provided and the design used, we will focus on mitigating investment worries around investing in an ISA. Instead, we want our patrons to begin thinking about how they can receive strong investments while also helping their future protégés achieve their financial goals.

DESIGN We will create a separate login portal for patrons to create an account, only accessible via a one-time login code. The design of the patron portal will have less of a "tech" feel and focus more on the page's content. That being said, we will provide interactive graphics that show a hypothetical patron fund's growth over time. We will use graphics to better highlight the ISA process, emphasizing its simplicity in signing up.

Entry Strategy

Entry Strategy I – Institutional ISA Investment Platform

Paytronage's preliminary entry strategy into the ISA marketplace is to focus on establishing the dual-sided marketplace. We foresee this as a textbook "chicken and egg" problem. As a result, we will attempt to target both groups simultaneously—with a large focus on targeting highly influential pilot schools we are connected to.

PATRONS We will target top tier universities, nonprofits, and accredited investors. By targeting non-profits such as the NAACP, YMCA, and Boys and Girls Club, Paytronage will sell philanthropic organizations on the beneficial offers of ISAs to their respective members. Simultaneously showing these organizations both the necessity and financial reward of ISAs will allow Paytronage to overcome the lack of financing that early movers could not tackle. Although initial investment yields will be low, on average, at the beginning of most ISAs, these patrons realize that their investment yield will grow and likely surpass the initial capital offered.

In order to be the trusted platform of universities and institutions, Paytronage will first target top-tier universities to join the platform. Starting with Connor and Zach's alma mater, the University of Pennsylvania, they plan to branch out to the rest of the Ivy League as many are already considering ISAs. From here, the team will cast a wide net and onboard other universities, non-profits, and large institutions to sponsor young adults with ISAs. Eventually, with enough patrons and protégés, Paytronage will be able to offer pooled investments and begin seeking the funds of non-accredited investors.

PROTÉGÉS Our aim is to initially target 18-25 year old students pursuing higher education. This includes secondary education such as college, university, or more advanced higher education such as doctorates, law degrees, MBAs, etc. These are the individuals we feel would most benefit by relieving the financial burden they have yet to undertake. Eventually, we will focus our efforts outside of this niche and focus on those repaying consumer loans, starting new companies, financing personal endeavors, etc.

We plan to promote a tagline, "Invest in yourself. Insure for the future. Pursue your dreams."

Tangibly, we will provide marketing to our patrons that sign up with our platform. In addition, we will target market outside of Paytronage's patrons to the broader educational ecosystem. The goal here is to have more potential protégés pressuring their university or institution to become a patron. If a patron has a positive experience after receiving funding through their ISA, we can continue to sell them our services.

GRASSROOTS TARGETING Paytronage plans to utilize its founders' university connections to create pressure among a university's student body before pitching the platform to the respective university administration. For example, Zach and Connor will identify influential members of the student body communities at targeted universities before Paytronage pitches the Patron to join the platform. Paytronage will speak with these members of the student body, and convince them to write columns for the university's respective newspapers on the innovative aspects of ISAs. Because student loans are a personal issue for the majority of students on a campus, this will inevitably create a certain amount of buzz and dialogue surrounding ISAs. Paytronage will then follow up to speak with the different members of the university's administration (likely financial aid officials or endowment funds), use the positive benefits of ISAs, highlight the track record of past investment funds, and cite their own students interest in the product to make the sale.

Entry Strategy II – Defaulted Student Debt Refinancing

Paytronage acknowledges that universities may be slow to adopt our platform before we have a proof of concept. While we fundamentally believe we will be able to get pilot universities onto our platform to help shape the future of ISAs, we have a secondary strategy to ease investor concerns:

DEFAULTED DEBT REFINANCING FUND According to the Federal Government, a loan is delinquent after 270 days of missing payments. In the Federal Direct Loan Program alone, there are $112.9B of loans in deferment, $100.1B loans in forbearance, $74.9B in default, and $26.2B in grace period. This represents $314B of federal loans that are in a state of delinquency. This is spread across 11.9M borrowers. Approx. $27,000 per individual.

The Federal government is willing to sell these delinquent loans to institutional third parties for very low prices. Paytronage plans to have a platform in which students/graduates are able to refinance their delinquent loans into ISAs—we then purchase their loans from the government for cheap and offer an ISA to these individuals. This transaction results in very high income-equity requirements. The fund of delinquent loans will be pooled, mitigating risk.

Individuals will choose to refinance their loans because ISAs offer significantly more payment flexibility at a cheaper rate. While they were delinquent on their federal loans, with ISAs, our contract structure will allow individuals to have a fresh start.

In this space, there are no competitors. No existing ISA provider focuses on refinancing defaulted debt and transition it to ISA offerings. As a result, we could establish our positioning and knowledge in the ISA space with little to no competition, and a very real market need. We will be first to market and attack this $314B and prove the merits of our algorithm.

From the debt refinancing and ISA offering establishment, Paytronage would then expand out to universities to show our niche knowledge in the space, and then sell them on the Patron/protege platform after our proof of concept and returns.

To illustrate with an example, Steven took out $100,000 of student loans and is unable to pay them because of mounting interest. He has been out of work for the past 7 months and is searching, but due to the economic state of his town, he hasn't had any luck. Steven is "in default".

Steven comes to Paytronage's platform and sees that he can refinance his loan, which continues to accumulate interest and drive his credit lower, for an ISA, which is tied to his income, so he has less stress while finding a job.

Because Steven's loan is in default, Paytronage is able to buy out the loan from the government for $15,000. We then price Steven an ISA for something in between the $100,000 he owes, and the $15,000 he pays. For example sake, Steven's debt is now cleared and he is obligated to an ISA with an equity requirement he would need to have received if he was requesting $50,000. Thus, Steven owes 10% of his income for the next 10 years. Paytronage creates immense margin on the difference between the $15,000 purchase price from the Federal Government and the projected $50,000 of income payback.

In this case, Steven is incredibly pleased—he owes $50,000 less on average, and the ISA mechanisms allow him to avoid paying if he falls victim to tough times again. The government is pleased because they were able to liquidate some of their $300B+ of defaulted loans, and our investors are pleased because they just bought 10% of Steven's total income for the next 10 years for $15,000.

Projected Market Share

We believe that we will be able to capture a large portion of the ISA market. Given the low number of players currently in the space, and our emphasis on early and quick growth, Paytronage aims to capture 50% of the market. This is also under the assumption that there will be a number of other competitors that enter and begin to fight for market share.

Appendix

Reasons Why Upstart & Pave Pivoted Yet Paytronage Will Succeed

REASON 1 In 2012, the ISA space was incredibly young—leading to a lack of investment from the collection of individual investors, that led to a lack of ISA recipient adoption. Upstart's crowdfunding investment platform was created for investment in potentially high-net worth individuals.

WHY PAYTRONAGE WILL SUCCEED: The ISA market has since gained awareness over the past five years. In addition, Paytronage will target all individuals that meet a patron's investment criteria. Therefore, there will not be the same limited supply of protégés on our platform.

REASON 2 Public awareness of ISAs was too low to have a kickstarter platform specifically focused on providing education-based loans.

WHY PAYTRONAGE WILL SUCCEED: Paytronage will not be limiting ISAs to education specific loans only, but rather creating an extensive marketplace for anyone who is looking to enter into an ISA. Furthermore, Paytronage will be in the market roughly five years after Upstart's pivot, which was before three separate Congressional bills (Investing in Student Success Act of 2014, 2015, and 2017). The push by Congress, as well as the adoption of ISAs by high-profile universities, such as Purdue University, Penn, MIT, and Harvard will continue to improve the public's perspective on this innovative investment vehicle.

REASON 3 Upstart's original crowdfunding site had a 3 percent conversion rate.

WHY PAYTRONAGE WILL SUCCEED:

- With the growth of ISAs to come, there will need to be a platform to compare all potential ISAs against one another.

- Conversion could have been low because users were only offered Upstart's ISA rate. Paytronage will offer several different ISAs from all of its patrons.

REASON 4 Upstart and Pave worked in a model in which investors could invest small increments - effectively crowdsourcing. They did not seek enough funding and create ISA-funds in their model, which led to poor adoption on the ISA-recipient side.

WHY PAYTRONAGE WILL SUCCEED: Paytronage will not focus on a crowdsourcing model, but instead a collective investment model for large institutional investors. With large players like universities, philanthropies, and potentially investment banks and investment management firms, capital will be flush with each additional patron that joins. With more capital coming from patrons, protégés will be more likely to use our platform.

Financial Instruments Explained

FEDERAL PERKINS LOANS Colleges may award these loans to students with the highest financial need, using federal government money. The subsidized, 5 percent fixed interest rate is low, and students don't make any loan payments while in college. Over their lifetime, undergraduates can borrow up to $27,500 and graduate students can borrow up to $60,000.

FEDERAL DIRECT SUBSIDIZED LOANS These need-based loans have a low interest rate of 3.76 percent, and the government pays the interest charges while students are in college. This interest rate is fixed and allows students to borrow up to $5,500 depending on their grade level and dependency status.

FEDERAL DIRECT UNSUBSIDIZED LOANS These non-need-based government loans have a fixed undergraduate interest rate of 3.76 percent and graduate interest rate of 5.31 percent. Students can choose to pay the interest while they're in college or add it to the amount of your loan. Students can borrow up to $20,500 depending on their grade level and dependency status.

FEDERAL DIRECT PLUS LOANS This federal loan is offered through colleges to parents with relatively good credit. The interest rate on this loan is 7 percent for the 2017-2018 academic year, but is variable based upon the ten-year Treasury note. The rate is capped at 10.5 percent, and repayment begins shortly after the funds are disbursed. The maximum Direct PLUS loan amount is the difference between the college's cost of attendance and all of the other financial aid that has been awarded.

PRIVATE AND STATE LOANS These loans from banks, colleges, private organizations and state government agencies usually are not need based or subsidized. They may require good credit, which often means an adult with good credit must cosign the loan. Interest rates on these loans are often higher than on federal loans, and the rates may rise over time. These loans may also have terms that are not as favorable as those of federal loans.

GRANTS Most grants, which do not need to be repaid, are awarded based on financial need and determined by the income reported on the Free Application for Federal Student Aid, or FAFSA. According to The College Board, in 2016, undergraduates at public colleges received an average of $5,000 in grant aid and those at private colleges received about $16,700. The biggest grant awards usually come from the college itself.

Colleges will take into consideration how much they think a family can afford to pay for college and try to fill in the gap with a grant. Some pledge to fill in more of the gap than others.

Federal Pell Grants, on the other hand, are capped at $5,920 a year and most go to families who earn less than $30,000 annually. Eligibility for state grants varies.

SCHOLARSHIPS Scholarships are awarded based upon various criteria, which usually reflect the values and purposes of the donor or founder of the award. Scholarship money is not required to be repaid. They can be awarded by the federal or state government, public or private institutions, non-profits, individuals, and universities.

TAX CREDIT The American Opportunity Tax Credit allows a parent to reduce their taxes after paying for tuition, fees, books, and room and board -- up to $2,500 a year per child. Parents can claim the tax credit if their modified adjusted gross income is no more than $90,000, or $180,000 if filing jointly.

HOME EQUITY LINE OF CREDIT A secondary mortgage loan based on the equity of a person's home. These loans offer high limits with low-interest, (almost always) variable rates with the home as collateral. This type of loan is different from a primary mortgage because an individual doesn't get a lump sum payment. Instead, the loan acts as a credit card and individuals can take out sums at any time during a 5-10 year period. During that period, the user is only required to pay interest. In the end, an individual only owes on what they take out. During the following repayment period, which is generally 10-20 years, the borrower is required to repay the principal as well as interest payments.

The amount of credit available is determined by subtracting the balance that the owner owes on his or her first mortgage by a percentage of the appraised value of the home, which is usually 80 percent.

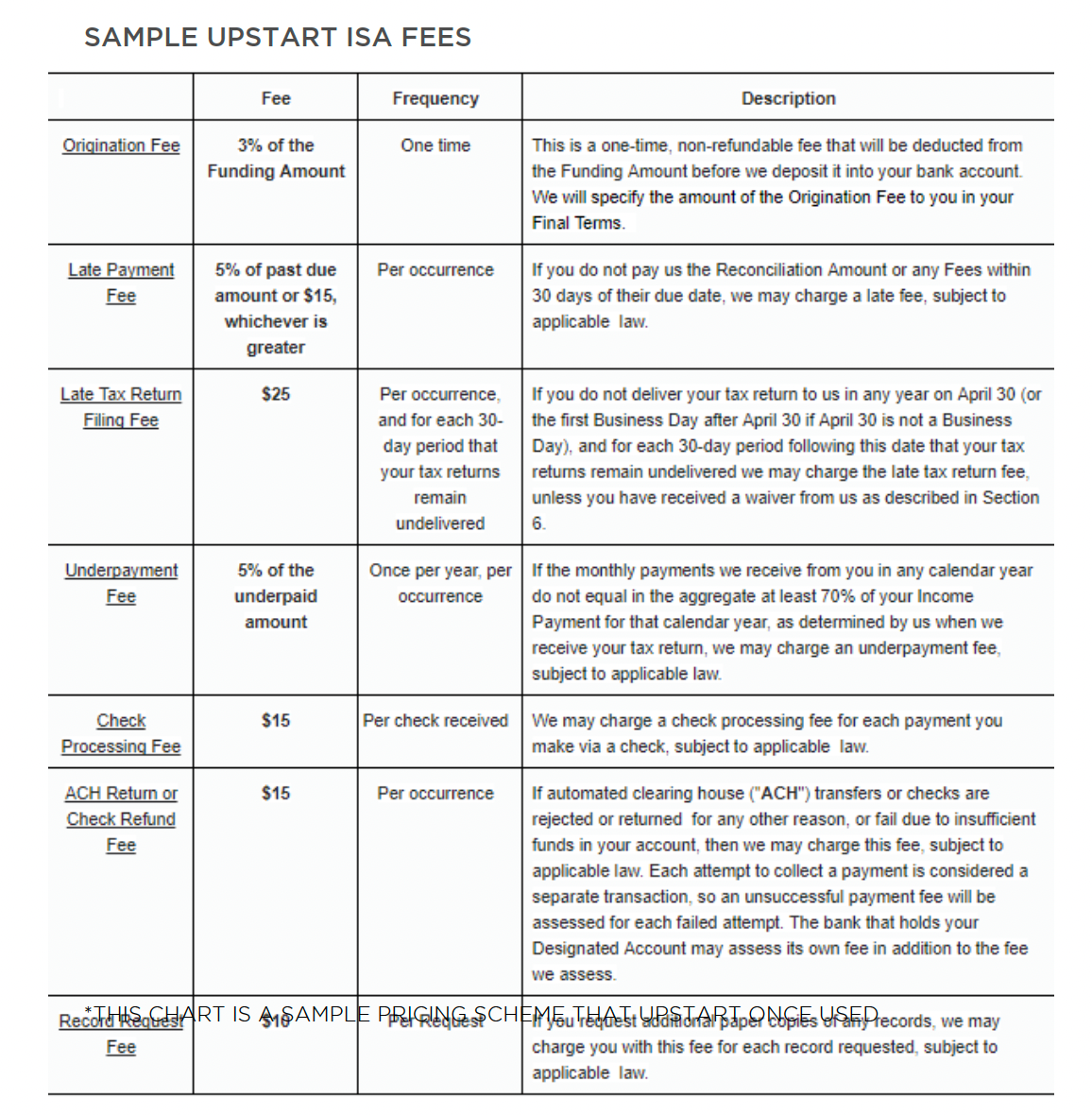

Sample Upstart ISA Fees

Upstart ISA Return & Volatility Market Comparison

Note: This document represents a business plan for Paytronage, a marketplace and investment fund for Income Share Agreements (ISAs).